Biography

About the life of a billionaire and an investor, regularly present in the first lines of the Forbes list, legends. An extraordinary lifestyle, the generosity of the patron, the history of personal family relations is all this inexhaustible source of interest and the basis of the plots of books and films about the biography of Warren Buffett.Childhood and youth

Warren Buffet was born in Omaha, Nebraska, August 31, 1930. The only son from three children of the couple of Buffett. Father Howard Buffett is an entrepreneur and an exchange player, remained an example for imitating and the object of adoration for the Son. In addition to success in business, Buffet-Senior built a political career by defeating the elections to Congress.

A boy from an early childhood showed math talents, with ease multiplying difficult numbers. Familiar believed his priest, and the schoolboy ended the cool extender program and showed the wonders of making money.

Biography of the billionaire from school bench is associated with investment, earnings and business. As Warren himself admits, he attracted the process of increasing capital. He always knew that he would become the owner of billions.

The first profit is obtained by a boy at six years. Having bought in the grandfather's store a package from six kola cans for 25 cents, sold each separately for 6, receiving 5 cents of clean revenue.

Purchase of the first shares took place when Warren was 11. The young businessman has acquired three shares of Cities Service Preferred for $ 38.25 for general and sister. Some time later, the price fell to $ 27, which made it thoroughly worrying a small businessman.

When the price tag rose to $ 40, Buffett hurried to sell shares, earning a net profit of $ 5 (including commission). And after some time, the cost took off to $ 202 for a valuable paper. So a novice investor learned the first rule - not to hurry and be patient.

Methods for earning a teenager amazed with diversity and strategic planning. Having settled up at the age of 13 to work out by the pedestronous newspaper, Buffett revised the delivery route, which made it possible to improve the path and increase the number of customers. Accordingly, the size of earnings has grown.

In the same 13-year-old, the teenager submits the first tax return, indicating the bike acquired on their own money and watches.

The next case was the installation of slot machines for Paintball in the hairdressers. Having persuading a friend to joint cooperation, Buffett was whispered out of construction, repaired them and installed in places of waiting, such as beauty salons.

The earned money was postponed and copied with leaning Warren. Soon savings enough for the purchase of a land plot, which the entrepreneur leased to farmers, having received a source of passive income.

As for study, then graduating from school, the young man did not burn with the desire to spend time on further education. Moreover, by that time, some of some teachers knew more and earned themselves. At the insistence of Parents, the young man still entered the University of Pennsylvania. By the way, since 1942, the family lived in Washington than Warren was dissatisfied. He loved his hometown.

In the end, studies in Pennsylvania did not work out. The young man threw the university, moved back to Nebraska and received a bachelor's degree in his native state. After that, attempted to enter Harvard, but received a refusal due to too young.

It turned out the favor of fate. Enrolling in Columbia University, a novice businessman fell under the wing of Benjamin Graham - Investor and Financier. The teacher significantly influenced the life of Buffeta, taught a young man by the main gold rules of the investor, instilled a love of business and long-term investments.

Business

In 1956, in his native Omaha Buffett creates the first own investment partnership, seeking five years of growth in the value of shares on incredible 251%. The investor's tactics were a thorough analysis of companies that were not limited to annual reports on profits. Millionaire was interested in the biographies of top managers, the history of the company, development prospects.

The strategy and foresight of the entrepreneur led to the fact that in 1965, pre-dissolving the partnership, the investor acquires a textile company on the verge of Berkshire Hathaway. Then there is a change in the direction of the company's activities on insurance transactions and investments. Now the organization is still the main for the billionaire.

Buffett adheres to the rules on the investment of capital into simple and understandable areas of business. It often acquires packages of shares of those companies whose products themselves prefers to use. During the investment activity, the entrepreneur acquired shares of Coca-Cola companies, Washington Post, "Gillett", McDonalds.

At the same time, "Oracle from Omaha", as the Buffett nicknamed in the press, notes that it is meaningless to predict the stock exchange market. Investments are worthy of only those companies that will remain on the market for many years. The famous Quote Warren says:

"Favorite sale of shares - never."Long-term investment with an average period of investments in 10 years is a distinctive feature of the billionaire stock exchange strategy. Patience and excerpt stand on the first lines of the list of golden rules of investment developed by Buffett.

It is interesting to notice that for a long time the IT company did not deserve attention to Buffett. Most likely, the reason for this lies in the conservatism of the billionaire. He himself repeatedly admitted that it was necessary to invest in those industries in which something you understand. Only in 2011, Warren acquired IBM shares.

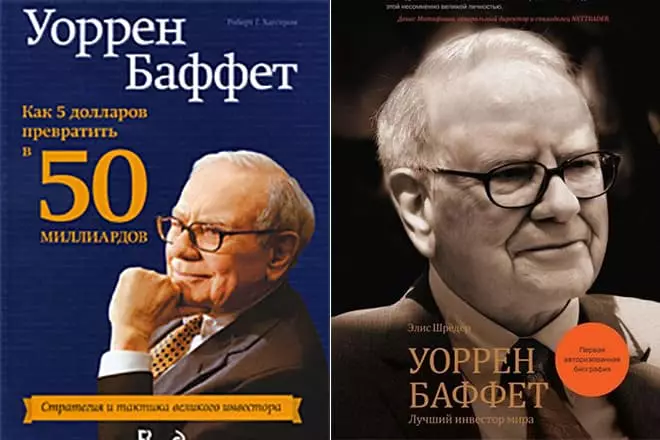

Whether it is surprised that Warren Buffett, his investor talents and stock strategist became a tempting plot for writing books. Secrets of success and investment lessons a billionaire shared with the author of the book "Warren Buffett. How $ 5 turning $ 50 billion "Robert Hagstrom, as well as in the first authorized biography" Warren Buffett. The best investor in the world, "written by Alice Schroeder.

The legendary billionaire appeared on the cinema screens. A lot of documentaries were shot about the investor's life, among the latter - "Become Warren Buffett", published in 2017.

Personal life

In 1952, Susan Thompson became an investor's wife. In marriage, three children appeared in a couple - Susan, Howard and Peter. The wife supported her husband, influenced the political views of the spouse, as well as at attitude to charity. However, when children grew up, Susan left Warren and the rest of the life of the couple lived separately, while not officially dissolving the marriage.

Meanwhile, the woman did not cease to be a friend for Buffett. She also introduced an investor with Astrid Menks, with which a billionaire since then consisted in close relationships. Astrid is a native of Latvia, who lived in the States all his life.

Susan until the end of the days retained a wonderful relationship with his spouse and his new lover. In 2004, Buffet's wife died from cancer, and two years later Warren legalized the relationship with Astrid, which lasted over 20 years.

By the way, the tests of the oncological disease did not escape and Buffet himself. In 2012, he successfully passed a five-month course of treatment against prostate cancer.

The lifestyle of the billionaire is different from the usual and stereotypical. The investor lives in a modest for rich house in Omaha, on five bedrooms, bought back in the 50s. A billionaire loves fast food, and the secret of his own longevity and energetic considers five daily cans of the adorable "cola".

The children of the hats were brought up in ascetic conditions of the middle class ordinary family. Everyone went to public school and until the conscious mature age did not even suspect the richness of the Father. However, the Billionair family fully supports the lifestyle of the head of the family.

The investor is distinguished by generosity in charitable promotions. In 2010, I donate more than 50% of our own capital of the Foundation of the Gates, the leader of the Forbes list of contemporaries. In the same year, a campaign, named "oath of donation", together with his friend Bill Gates organized. Those who wish to join are obliged to promise to transfer at least half of their wealth to good goals.

Warren Buffet now

In March 2018, Forbes magazine published another rating of the richest people in the world. According to the results and reports for 2017, Buffett took the third list of the list. I lost in the amount of the billionaire the owner of Amazon Jeff Bezosu and his partner in Bridge Bill Gates.In January 2018, a lot of noise has made a Buffetta Statement about the change of the management of the investment company and readiness to name the name of the successor. However, the investor assured that he himself feels perfectly and continues to love what he was doing.

State assessment

According to the same rating "Forbes", the billionaire state in 2017 amounted to $ 84 billion, which is $ 8.4 billion more than in the previous one.